For many business owners, the SBA can seem like the answer to a prayer. But in this, as in most other things having to do with government, the ideal theory is better than the practice. Long wait times, extensive paperwork, and low approval rates means that the reality rarely matches the promise; for merchants who staked their business on getting one of these loans, the final rejection letter can leave them crushed and with few options. Part of the problem is the mix of an overly optimistic initial screening process (which gives many merchants unrealistic expectations), combined with brutally difficult approval conditions.

With small business funding through a merchant cash advance, you’re not dealing with some massive and inefficient government bureaucracy. You’re dealing with motivated professionals in a highly competitive field who must innovate and maximize efficiency in order to survive. Part of the problem with the SBA is that it doesn’t operate under market forces, and so has no incentive to innovate. And if you need to talk to someone at the SBA about lowering payments for a week, or customizing the deal for your specific business, be prepared to endure a maze of government bloat, runarounds, and clueless office workers.

A merchant cash advance gives you the chance to deal directly with other business owners, whose product is getting you a business loan. You take pride in your services, and so do we. Our already low in-house rates can easily beat anything from the SBA, especially if you pay the deal early, which nets you a 7% savings on the balance.

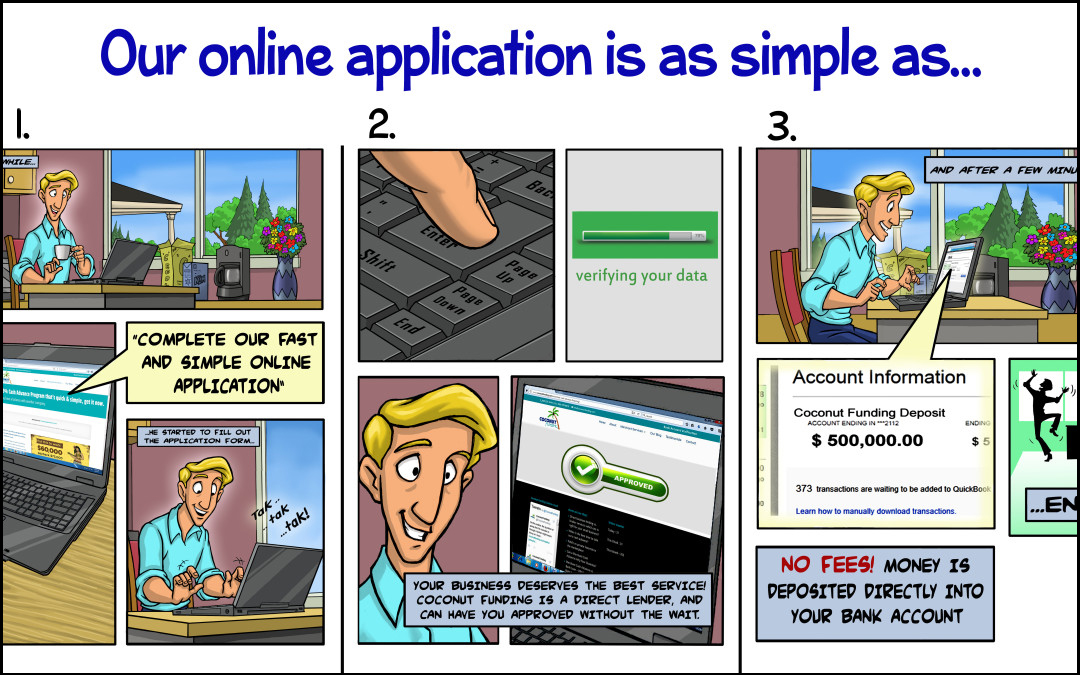

Don’t hang your business out to dry. With Coconut Funding you get:

- Fast service: same day approvals and funding. Don’t wait around for months with the SBA!

- Minimal paperwork.

- Deal with professionals at a family-owned company.

- Up to 500k in funding per EIN.

- 7% savings for paying early.

- In-house funding